- Bitcoin HODLing reached a 12-month excessive indicating wholesome accumulation.

- Upside potential continues to be restricted amid low whale and institutional demand.

It has been some time since Bitcoin [BTC] delivered a large efficiency. In case you are like most crypto fans, chances are high that you're questioning whether or not BTC will provide some redemption in 2023, or even perhaps this month. Properly, in the event you occur to be on this camp, listed below are some issues to think about.

Learn Bitcoin’s [BTC] value prediction 2023-2024

What would it not take for Bitcoin bulls to point out themselves robust? Properly, one of many solutions is that long-term HODLing must be dominant. The excellent news on this regard is that Glassnode Alerts have revealed that the Bitcoin provide final energetic 2-3 years is now at a 12-month excessive. In different phrases, the variety of addresses hodling their BTC is rising.

???? #Bitcoin $BTC Quantity of Provide Final Energetic 2y-3y (1d MA) simply reached a 1-year excessive of 1,668,534.379 BTC

View metric:https://t.co/ov1FrjgNQz pic.twitter.com/JdcwR8UNQi

— glassnode alerts (@glassnodealerts) January 4, 2023

However the quantity hodled inside this 1-year interval represents roughly 0.02% of the Bitcoin in provide. This implies the potential impression of this hodl is minimal, though it would provide important cushioning towards the draw back.

Can whale and institutional exercise foot the invoice?

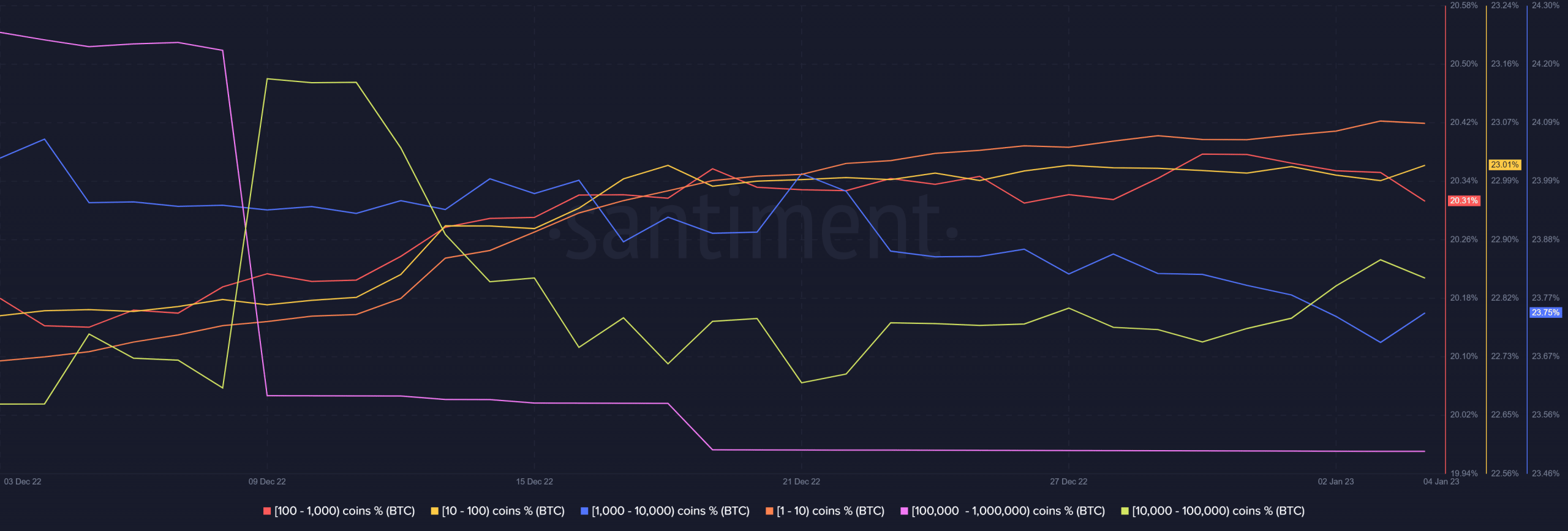

For the reason that quantity of BTC hodling is simply too low to drive up the worth, the following main consideration for the bulls is whale and institutional demand. An evaluation of Bitcoin’s provide distribution reveals a combined bag so far as whale addresses are involved. Some addresses are contributing to purchasing stress whereas others are contributing to the promoting stress.

Supply: Santiment

Promote stress in December got here from the most important deal with classes. Addresses holding greater than 100,000 BTC have been inactive this week however these holding 100 to 1,000 BTC in addition to 10,000 to 100,000 BTC have contributed to promoting stress. These within the 10 to 100 and 1,000 to 10,000 purchased within the final 24 hours, at press time.

Additionally value noting is that smaller addresses (the retail phase) have been shopping for. One other fascinating statement is that institutional demand continues to be missing. The Function Bitcoin ETF Holdings has been offloading its BTC within the final 4 weeks, thus contributing to promoting stress.

Supply: Glassnode

What number of BTCs are you able to get for $1?

The above observations recommend that retail accumulation is supporting the present value stage. As well as, Bitcoin change reserves grew within the final 4 weeks, which is according to the promoting stress noticed from whales. Derivatives demand for BTC additionally scaled up barely, and so did leverage.

Supply: CryptoQuant

The upper estimated leverage ratio means that we'd see a return of volatility within the subsequent few days. However, it's nonetheless too early to name whether or not it will likely be bullish or bearish volatility.