- AVAX’s metrics regarded bearish detailing why AVAX was on a downtrend.

- Nevertheless, progress was famous in AVAX’s NFT ecosystem as gross sales elevated.

Avalanche’s [AVAX] efficiency on the worth entrance was regarding for the buyers, because it declined by greater than 5% within the final 24 hours.

In response to CoinMarketCap’s data, AVAX’s worth registered a decline of three% final week, and on the time of writing, it was buying and selling at $19.86 with a market capitalization of over $6.2 billion.

This downtrend will be attributed to the present market situations, which have restricted a lot of the cryptos from registering positive factors. Nevertheless, a have a look at Avalanche’s on-chain metrics revealed that there was extra to the story.

How a lot are 1,10,100 AVAX value right this moment?

These are the issues

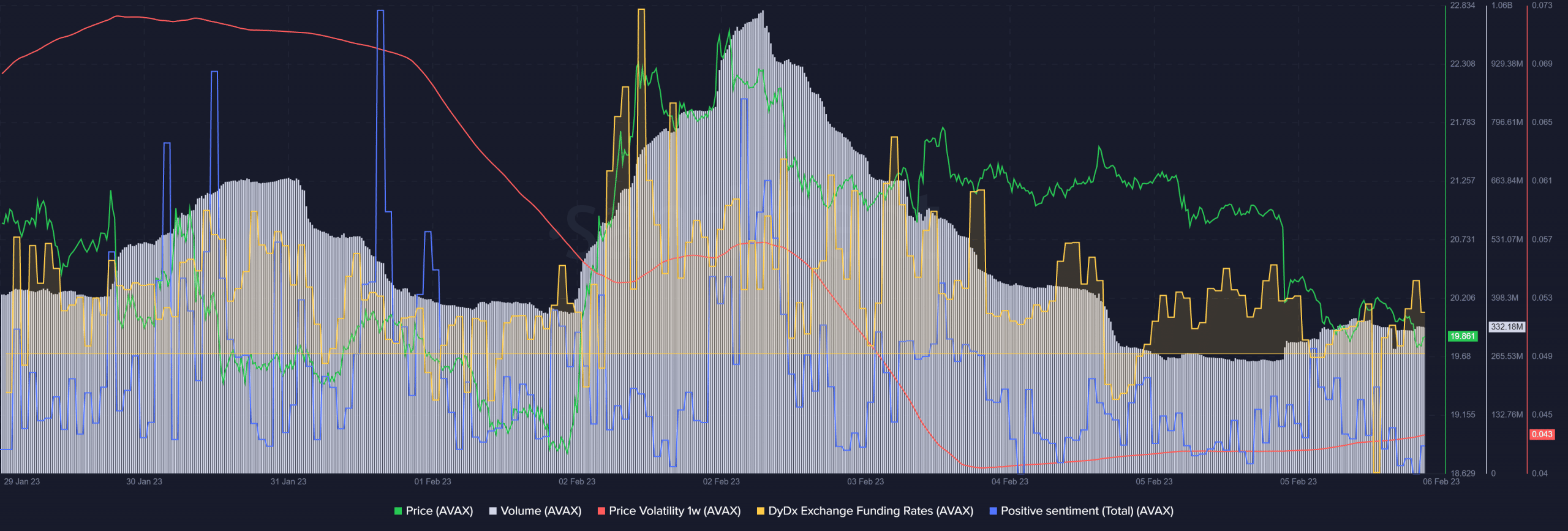

Santiment’s chart identified that AVAX’s quantity decreased considerably, which by and huge was a detrimental sign. The demand from the derivatives market additionally took a blow because the DyDx funding price went down.

The crypto neighborhood’s confidence in the coin additionally appeared to have plummeted as its constructive sentiment metric decreased.

The latest worth decline was accompanied by a rise in AVAX’s 1-week worth volatility, suggesting an additional downtrend contemplating the remainder of the metrics.

Furthermore, DeFiLama’s data revealed that Avalanche’s Complete Worth Locked (TVL) registered a 24-hour decline of greater than 2%.

Supply: Santiment

Reasonable or not, right here’s AVAX’s market cap in BTC’s phrases

Is a development reversal viable?

Curiously, despite the fact that the week was not good for buyers, AVAX’s NFT area had issues going for itself. AVAX Each day launched Avalanche NFT weekly highlights, which identified the ecosystem’s progress.

As per the most recent information, the NFT gross sales and gross sales quantity elevated by double digits within the final seven days.

????Avax NFT Weekly Highlights????

MarketCap: $45.32M

Quantity: $299.02K

Gross sales: 8912#AVAX #Avalanche $AVAX #NFT #GameFi pic.twitter.com/9Rz2HyWkD2— AVAX Each day ???? (@AVAXDaily) February 4, 2023

Whereas SWARMS remained essentially the most spectacular NFT with 19 gross sales at a mean worth of $45.24 final week, the remaining NFTs had a quantity smaller than 10 NFTs.

For a number of weeks in a row, Chilkn Roost and OG Odin held the highest quantity positions. Final week, Chad Doge Supers joined Chilkn Roost and OG ODIN on the listing, indicating that the venture was gaining traction with consumers.

Nonetheless, progress within the NFT area didn't appear to be sufficient for AVAX to provoke a development reversal, because the day by day chart additionally painted a bearish image.

AVAX’s Relative Energy Index (RSI) registered a downtick and was heading towards the impartial mark, which was bearish. The Cash Movement Index (MFI) additionally selected to comply with the same route.

Furthermore, AVAX’s Chaikin Cash Movement (CMF) was resting beneath the impartial mark, additional rising the probabilities of a continued downtrend. Nevertheless, the Exponential Shifting Common (EMA) Ribbon remained bullish because the 20-day EMA was above the 55-day EMA.

Supply: TradingView