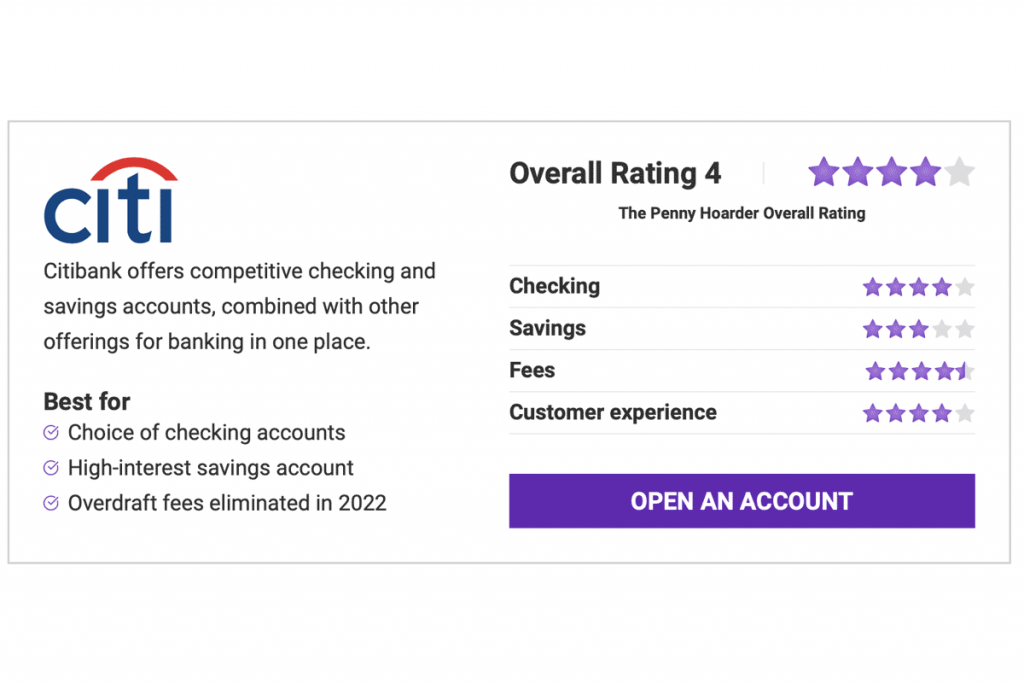

As one of many largest banks on the earth, Citibank has so much to supply its prospects — from helpful on-line options to 1000's of free ATMs. It’s additionally a worldwide financial institution, with 1000's of abroad branches to enhance the 700+ in america. That provides Citi a particular edge over on-line banks that haven't any native presence in any respect.

That mentioned, Citibank falls brief in a number of areas — specifically, the rates of interest on a few of its accounts are lower than stellar. Moreover, Citi has been heavy on the month-to-month charges, and whereas there are methods to waive them, we’d choose to not take care of them in any respect.

In February 2022, Citibank turned the most important financial institution within the nation to announce it was dumping all overdraft charges, returned merchandise charges and overdraft safety charges by summer season 2022.

On the finish of the day, Citi is a strong financial institution that will get so much proper. However is a Citibank account proper for you? Learn on to seek out out.

Citibank Checking Accounts

Citi gives quite a lot of checking account choices, starting from primary digital accounts to high-yield curiosity checking. There are additionally a number of premium tiers obtainable.

Citi Fundamental Banking

Greatest for On a regular basis Checking Wants

Key Options

- A number of tiers of checking accounts obtainable

- No minimal beginning steadiness

- Earn curiosity on checking account steadiness

Citi’s primary checking account, the aptly named Fundamental Banking Package deal, gives all the pieces you’d count on from a normal checking account. It’s a no-frills choice that makes a implausible starter account. All overdraft charges, returned merchandise charges and overdraft safety charges have been eradicated.

Citi Fundamental Banking

Month-to-month charges

$12 (will be waived)

ATM charge

2.50 for non-Citi ATMs (will be waived if account holder is over 62 years previous)

Minimal beginning steadiness

None

APY

n/a

Extra About Citi Fundamental Checking Accounts

Citibank gives a number of checking account choices. Whilst you can open one up by itself, a lot of the Citi accounts make extra sense when opened as a part of a bundle. These packages embrace a linked financial savings account and a handful of different perks, and we advocate going this route should you select to financial institution with Citi.

There are three On a regular basis Banking packages and three Premium Banking packages obtainable.

On a regular basis Banking:

- Entry Account Package deal

- Fundamental Banking Package deal

- The Citibank Account Package deal

Premium Banking:

- Citi Precedence Account Package deal

- Citigold Account Package deal

- Citigold Personal Shopper

A lot of the Citi checking account packages have a month-to-month charge, and in some circumstances it’s reasonably steep. Nevertheless, there’s almost all the time a easy approach to waive that charge. For instance, the Fundamental Banking Package deal has a $12 month-to-month service charge, however you possibly can waive it in a variety of methods:

- Make one qualifying direct deposit and one qualifying invoice fee every assertion interval.

- Keep a mixed common of $1,500 in eligible linked accounts.

- The primary-listed account proprietor is over 62 years previous and opened their account earlier than July 18th, 2022.

- It’s a joint account that features a minor and the account was opened earlier than July 18th, 2022.

Each account has not less than one approach to waive the month-to-month service charge, even when it’s simply sustaining a sure minimal steadiness. That mentioned, we’d nonetheless choose no charges in any respect — which lots of Citi’s rivals provide.

It’s additionally price noting that the Entry Account bundle doesn’t have an choice for paper checks. If it is advisable to write checks, you’ll must go along with a special Citibank account.

Talking of all of the account choices — usually, we’re not a fan of too many decisions. Nevertheless, the assorted Citi checking accounts provide an inexpensive development from primary starter accounts by means of to the premium choices, and it’s comparatively clear if you’d select which account. On this case, we’d truly say the range works in Citi’s favor.

Citibank Financial savings Accounts

Not like the checking account selection, Citi actually solely gives a single financial savings account choice: Citi Speed up Financial savings. Nevertheless, this account is definitely an impressive choice with a really aggressive rate of interest — you actually don’t want rather more.

Citi Speed up Financial savings

Greatest for Excessive-Yield Financial savings

Key Options

- Wonderful rate of interest — as much as 3.40% APY

- No minimal opening steadiness required

- A number of methods to waive month-to-month charges

The Citi Speed up Financial savings account gives a aggressive 3.40% APY, making it a gorgeous choice for anybody seeking to hold their checking and financial savings accounts below one roof.

Citi Speed up Financial savings

APY

3.40%

Month-to-month charges

Begins at $4.50, however will be waived

ATM entry

2,300 Citibank ATMS; 60,000 others charge free

Minimal beginning steadiness

None

Extra About Citi Speed up Financial savings Accounts

A Citi financial savings account makes a superb companion to one of many Citi checking accounts. The three.40% APY price is sort of good, and there actually aren’t any charges hooked up to the account — it’s typically very straightforward to fulfill the necessities to waive the month-to-month service charge.

Add in the advantages of a Citi banking bundle to your Citi financial savings account, plus the massive nationwide ATM community, and also you’ve obtained a strong financial savings account choice that’s straightforward to advocate. That mentioned, should you’re solely searching for a financial savings account, we predict you possibly can most likely do higher with one other financial institution.

Different Citibank Choices

Being a big world monetary establishment, Citibank gives quite a lot of different merchandise apart from checking and financial savings accounts. These embrace CDs, IRAs, and quite a lot of small enterprise choices.

Certificates of Deposit (CDs)

Certificates of Deposit accounts, or CDs, are a particular sort of financial savings account that has a hard and fast rate of interest and glued phrases. In observe, which means CDs are secure investments, however that when your cash is in a single, you possibly can’t entry it (with out penalties) till these phrases are up. They’re best for holding cash that you realize you wish to save for a sure date, or for a secure and assured return on funding with out a lot threat.

Citibank gives an array of CD accounts to fulfill your longer-term financial savings objectives. There are three decisions: a Mounted Price CD, a Step-Up CD, and a No Penalty CD.

Citibank Mounted Price CD

Greatest for Secure Investments

Key Options

- Number of time period lengths obtainable

- Secure rates of interest that gained’t change on you

- Low minimal beginning deposit

The Citibank Mounted Price CD is Citi’s model of a “commonplace” CD account. It gives a variety of time period lengths and rates of interest for these wanting to save lots of with function.

Citibank Mounted Price CD

APY

As much as 4.15%

Time period size

3 months to five years

Minimal beginning steadiness

$500

Extra About Citi Mounted Price CD

The Citi CD accounts provide a strong choice for those who have particular financial savings objectives in thoughts. The Mounted Price CD is a normal CD account and gives a variety of phrases and rates of interest, from 3 months to five years.

The Step-Up CD is a barely completely different choice to most CDs. This account is on a 30-month time period and the rate of interest will increase each 10 months over that time period, from 0.05% to 0.15% APY.

Lastly, Citibank gives a No Penalty CD, which is a bit more versatile than a typical CD account. The No Penalty CD has a 12-month time period and allows you to withdraw your full steadiness with out the same old penalties related to a CD account. As a tradeoff, the rate of interest on the No Penalty CD is mounted at 3.40% APY.

Different Citibank Options

Citibank’s measurement additionally helps make obtainable a full-slate of banking options. Listed here are two that you'd count on to have at a big financial institution. And in relation to cell banking, any financial institution actually.

Credit score Playing cards

Citi gives all kinds of bank cards, from journey and rewards-based playing cards to money again and enterprise. Rates of interest and money again quantities are fairly commonplace for bank-issued bank cards. In different phrases, count on round 17%–29% curiosity and round 2% money again for the very best choices. These playing cards make good choices for those who wish to hold all their accounts below one roof.

Loans

Citi additionally gives a variety of mortgage merchandise, together with small enterprise loans, house loans, and private traces of credit score. Private loans are restricted to a max of $30,000 and provide reimbursement phrases of 1 to 5 years. Just like the bank card merchandise, these are good should you want just a little further money and wish to hold all the pieces in the identical monetary establishment. There’s nothing inherently particular about them in comparison with choices from different banks, although.

IRAs

In case you choose a extra long-term choice for saving — say, to fund your retirement — Citi gives Particular person Retirement Accounts (IRAs) with no annual charges. IRA stands for Particular person Retirement Account, and it’s a sort of long-term financial savings and funding account that's supposed particularly for retirement financial savings.

Citi’s IRA choices embrace each conventional IRAs and Roth IRAs, and the accounts earn between 0.05% and 4.97% APY, relying on the kind of IRA you select. Choices embrace an Insured Cash Market account, Variable CD, and Day-to-Day Financial savings accounts.

Typically, the cash market account goes to be the best choice for a long-term retirement account like this. A cash market account gained’t earn as excessive of an rate of interest as a CD, however you possibly can go away the cash within the account for much longer, so it can accrue a lot extra over time.

Cell Banking

The Citibank cell app is extraordinarily well-rated. It gives all of the anticipated options of a web based banking cell app, from account administration and verify deposits to customer support and even a spot to view your FICO credit score rating.

Whereas there’s not essentially something groundbreaking concerning the app, it’s straightforward to make use of and well-designed. Which means it excels at precisely what you’d need your banking app to do. Mixed with bodily branches, this makes Citibank a really handy choice for private banking.

As for on-line banking, you are able to do all the pieces you’d count on utilizing Citi’s web site, from transfers to paying payments. Plus, in contrast to even the very best on-line banks, Citi truly has bodily areas, so you possibly can go get money in hand should you want.

Execs and Cons About Citibank

Under is a listing of professionals and cons about Citibank that can assist you resolve if this financial institution is best for you.

Execs

- A number of decisions for checking accounts. It’s very straightforward to seek out one which matches your private monetary wants.

- A high-yield financial savings account with a superb rate of interest. The Citi Speed up Financial savings account is a implausible Citibank account choice for normal financial savings.

- Helpful packages that mix checking and financial savings accounts. These packages assist cut back charges and prices and simplify the banking expertise.

- Giant community of ATMs — 1000's can be found nationwide, and you may also use any out-of-network ATM for a small charge.

- Distinctive CD account choices — the Step-Up CD and No Penalty CD can be found along with the usual Mounted Price CD.

- All overdraft charges, returned merchandise charges and overdraft safety charges have been eradicated in summer season 2022.

Cons

- Excessive month-to-month charges. Whereas most accounts have a way to waive the charges, they're virtually universally increased than different banks.

- Lower than one thousand bodily areas in america. This can both be a non-issue or a deal-breaker, relying on the place you stand.

- Rates of interest are middle-of-the-road at greatest. CD accounts, specifically, earn lacklustre curiosity in comparison with many rivals.

Incessantly Requested Questions (FAQs) About Citibank

Have questions on Citibank? We now have solutions.

Is Citibank FDIC Insured?

Sure. Each Citibank account, together with checking, financial savings, and CD accounts, are FDIC insured. What meaning is that every account is mechanically insured for as much as $250,000 per depositor. That is meant to guard your cash within the occasion the financial institution fails — you gained’t lose the funds you’ve deposited in a Citibank account.

Citibank is owned by Citigroup, Inc. Citigroup is a worldwide monetary companies firm that serves over 200 million prospects world wide.

Citibank is a good financial institution with a variety of positives going for it. It gives a variety of packages that mix checking and financial savings accounts into an easy-to-manage bundle, and the mixed steadiness contributes to the brink to waive month-to-month service charges. Plus, the Citi financial savings account rates of interest are glorious.

Citibank isn’t excellent, in fact — the rates of interest are middle-of-the-road, and there aren’t as many native branches within the U.S. as a few of its rivals. Nevertheless, should you wan

Does Citibank Supply a Credit score Card?

Sure, Citibank gives a number of completely different bank card accounts along with the same old financial institution choices. Citibank bank card choices embrace money again rewards playing cards to steadiness switch and low-interest choices.

TWP contributor Dave Schafer has been writing professionally for almost a decade, protecting subjects starting from private finance to software program and client tech.