- Ethereum OFAC-compliant blocks have dropped, in response to current knowledge.

- Ethereum validators are additionally planning to make use of an replace that may see OFAC compliance decreased by 35%.

After this 12 months’s merge, Ethereum [ETH] modified from a Proof-of-Work (POW) to a Proof-of-Stake (POS) community. Due to the consolidation, validators at the moment are liable for defending transactions and the integrity of the community.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Nevertheless, censorship of blocks on Ethereum turned a heated matter, and the success of the merge was rapidly forgotten. Some analysts had been additionally dissatisfied with the dominance of OFAC-compliant MEV-boost relays and blocks.

OFAC-compliant blocks on the rise

The U.S. Division of the Treasury’s Workplace of International Belongings Management (OFAC) blocked the Twister Money mixer program in August. In response to the OFAC’s resolution, Flashbots, an Ethereum analysis and growth agency, revealed some vital updates.

The corporate declared that it might start censoring transactions utilizing a essential part of the infrastructure, relied on by validators working Ethereum’s POS community. The resultant impact was OFAC-compliant blocks.

The present state of MEVs

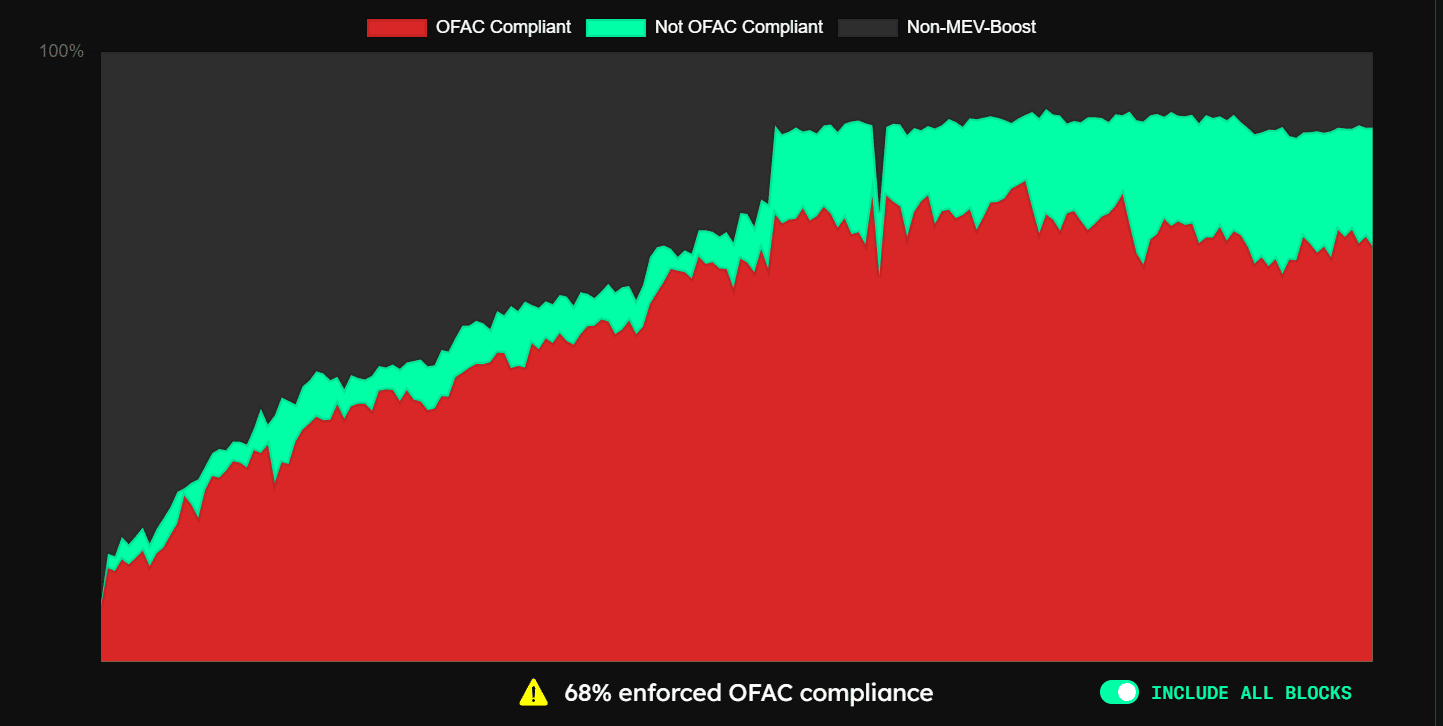

Info from mevwatch.io revealed that in September, the proportion of OFAC-compliant blocks began rising sharply, ultimately turning into probably the most dominant MEV. Throughout November, compliant blocks reached a excessive of 79%, with non-compliant blocks reaching 11% and 10%, respectively.

Nevertheless, as of this writing, the share of followers had declined to 68%, with 57% compliant blocks total. This progress was made because of the constant efforts of all gamers, particularly Flashbots.

Supply: mevwatch.io

By refusing Maximal Extractable Worth (MEV) funds beneath 0.05 ETH, validators would possibly scale back OFAC compliance by 35%, in response to analysis released by Flashbots in November and cited by Messari. This resolution would have a minor impression on their earnings.

Stakers rise both means

ETH stakers continued to be lively of their operations regardless of the issues concerning the compliance blocks. The worth had been growing, as evidenced by the Whole Worth Staked metrics from CryptoQuant.

In accordance with the info, as of 15 December, there had been greater than $15 million in stake. This meant that regardless of the issues concerning compliance and the centralization of ETH validators, extra ETH was being staked.

Supply: CryptoQuant

ETH faces decline

A each day interval chart of Ethereum (ETH) revealed that it had misplaced about 7% of its worth over the earlier 48 hours. The FOMC report that was made public on 14 December may additionally have contributed to the worth decline.

The quick and lengthy Transferring Averages (the yellow and blue strains) had been discovered to be appearing as resistance. The yellow line fashioned the resistance degree at $1,300, whereas the blue line did the identical round $1,500.

Supply: TradingView

In accordance with the Relative Energy Index metric, which was beneath 50, the general development of ETH was bearish. Provided that it had already reached the high-volume node zone, the Seen Vary Quantity Profile metric additionally steered that there was an opportunity of an additional drop. ETH was price roughly $1,200 on the time of writing.

The Ethereum neighborhood’s efforts to make the platform censorship-resistant and impartial are paying off. This alteration might trigger the variety of compliant blocks to progressively diminish.