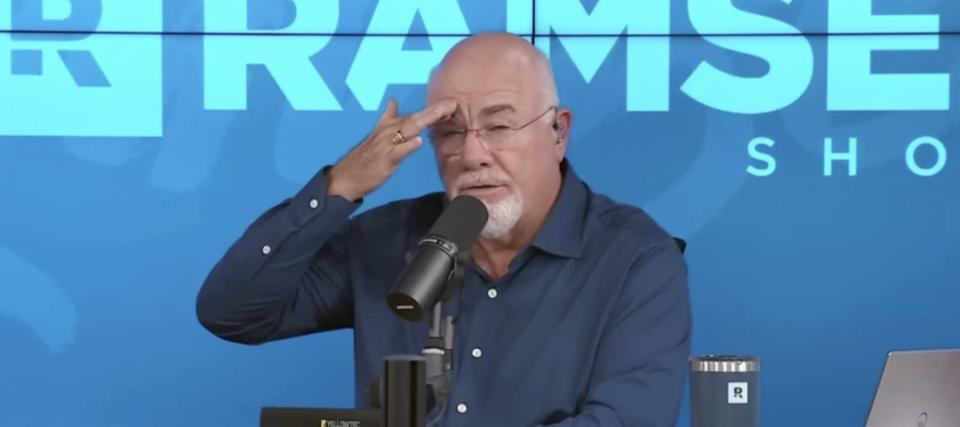

In terms of entire life insurance coverage, “It’s not a light dislike,” stated Dave Ramsey in a latest episode of “The Ramsey Present,” the place he’s supplied monetary recommendation since 1992. “I hate it.”

Why the disdain for whole life when so many People spend money on it? Half have some type of life insurance coverage, based on Annuity.org.

Do not miss

The thought is two-fold: First, having life insurance coverage permits individuals to dwell with a way of economic safety. And second, when a policyholder passes away, the beneficiary (or beneficiaries) obtain the funds from entire life insurance coverage investments.

But when counting the explanations for his hate, Ramsey has three. And identical to an overzealous insurance coverage salesman, they’re fairly exhausting to disregard.

1. Charges, charges, charges

For each $100 you spend money on entire life insurance coverage, the primary $5 goes to buy the insurance coverage itself; the opposite $95 goes to the money worth buildup out of your funding. Sure, however … for in regards to the first three years, your cash goes to charges alone.

Somebody is making out, and it’s not your beneficiary.

“It’s front-loaded as an funding,” Ramsey stated. “That isn’t essentially evil in and of itself however is frowned upon within the monetary funding world by and enormous.”

2. Awful returns

Okay, however you may have it your entire life, proper? Properly, it doesn’t get a lot better after the primary three years. The typical fee of return after these “three years of zeroes” shall be about 1.2% on that $95.

“Let’s be beneficiant and say it’s double that,” Ramsey stated. “It’s nonetheless not a superb long-term funding. If I might get 2.4% on my cash market I’d be dancing a jig, however not on my long-term investments.” These, he famous, have to be north of 10% to beat inflation and taxes.

“That makes it completely horrendous,” Ramsey contended. “A long time in the past the monetary neighborhood moved by and enormous in the direction of investing in time period life for the $5 from the $100, and doing virtually the rest with the opposite $95 — however over within the funding world as a substitute of the insurance coverage world.”

What’s extra, entire life payment constructions rob you of cash energy as a result of the sacrificed money denies you the compound curiosity you’d see by means of conventional investing. What’s extra, insurance coverage firms might refuse to refund any of your cash if you happen to can not sustain with the funds.

3. Guess who will get a lot of the dough while you die?

The stake within the coronary heart for entire life is that while you die, the insurer retains your cash. That’s proper: They take in the money worth of your coverage whereas survivors obtain the leftovers in what’s referred to as a “dying profit.” The policyholder can solely use the money worth whereas they’re alive.

It’s sufficient to make you would like you had insurance coverage in your entire life insurance coverage. Listed here are some higher methods to place your retirement allocations to work.

Learn extra: Here's how much the average American 60-year-old holds in retirement savings — how does your nest egg compare?

Different one: Time period life

As Ramsey mentions, time period life insurance coverage makes for a far better option. Time period life refers to a purchase order that lasts for a time period — possibly 10, 15 or 20 years — and ensures cost if an individual dies inside that time period.

With its restricted time period, time period is less expensive than entire. Word that it solely offers a dying profit and premiums rely in your age and well being standing. Know additionally which you could’t invest the money elsewhere — and don’t get it again if the time period expires and also you’re nonetheless alive. Take into account coupling time period funds with investments that can develop alongside them.

Different two: the 401(okay)

The 401(k) offers another financial buffer within the occasion of dying. But right here’s the issue: Many People don’t also have a 401(okay), together with those that freelance.

The excellent news for these with full-time jobs is that your employer might match your 401(okay) funding, often as much as 6% of your paycheck. That’s free cash in the direction of your retirement. Let’s repeat that: free cash.

Monetary advisers can then help you invest that retirement money. Additional, you get a tax break for investing within the 401(okay), as you gained’t be levied on these contributions till you make withdrawals. This may very well be while you retire or need to hand it all the way down to a beneficiary.

Different three: the Roth IRA

The great thing about any particular person retirement account (IRA) is which you could begin one even when you have already got a 401(okay). With a Roth IRA, you’re taxed up entrance. This advantages you while you withdraw money, as you’ve already paid the tax: What you're taking is what you retain (until, after all, you utilize it to purchase some entire life).

As with a 401(okay), you possibly can spend money on any inventory or index fund tied to the market to develop your funds. You may open one any time you need and maintain it for so long as you need. Withdrawals should be taken after age 59½ and/or after a five-year holding interval.

Backside line: It’s wholly your life

With so many choices to avoid wasting for the long run and your family members, there’s no purpose to sink your entire nest egg in entire life insurance coverage. It’s what huge insurers are betting you’ll do — however as Ramsey may put it, you’d be higher off washing out an orange marmalade jar as a substitute.

“Put the cash in a freaking fruit jar,” Ramsey quipped. “At the very least it’s there while you die!”

What to learn subsequent

This text offers info solely and shouldn't be construed as recommendation. It's supplied with out guarantee of any type.