Disclaimer: The knowledge introduced doesn't represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- The H4 and D1 market construction has remained bearish

- A transfer above $1.25 could be required to flip bias to bullish

Polygon [MATIC] famous robust positive factors on the worth charts in mid-February, a growth which highlighted that sentiment was optimistic in direction of the asset at the moment. Since then, nevertheless, the market has turned and people positive factors have been absolutely worn out.

How a lot are 1, 10, 100 MATIC value right this moment?

The active addresses metric has fallen since late January too whereas each day gasoline charges have declined over the previous two weeks. This hit to the protocol’s income might clarify a number of the losses MATIC has seen on the charts.

MATIC could possibly be set to fill an imbalance within the south

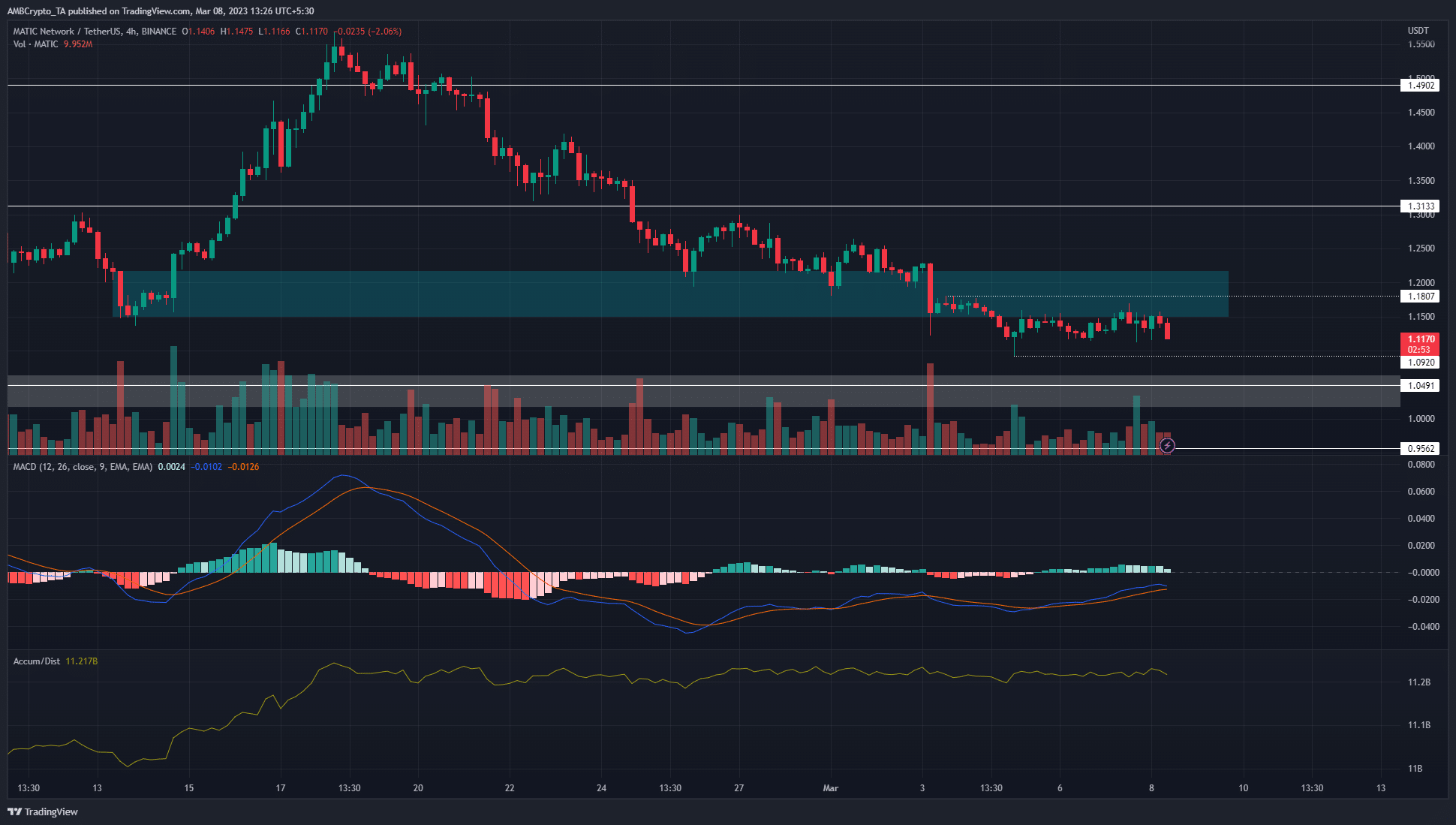

Supply: MATIC/USDT on TradingView

After the robust drop into the demand zone, MATIC didn't see a fast restoration. As a substitute, the costs dithered in regards to the $1.15-mark and plunged decrease as soon as extra. The market construction on H4 was firmly in bearish favor. The MACD was additionally below the zero line since 22 February to point out important downward momentum. Nevertheless, it shaped a bullish crossover on 5 March, indicating that bearish momentum was weakening.

The A/D line moved sideways in latest days and highlighted that neither patrons nor sellers loved management of the market. And but, the worth motion signalled bears had been clearly dominant.

There are two decrease timeframe ranges of resistance and assist at $1.18 and $1.09, respectively. Brief-term merchants can keep watch over these ranges, however it's probably that MATIC would drop in direction of the $1-area.

Lifelike or not, right here’s MATIC’s market cap in BTC’s phrases

On the each day chart, the worth had left a good worth hole (white field) within the $1.01-$1.06 space. Therefore, a transfer beneath $1.09 would probably fill this zone, and take a look at the $1 psychological stage as properly. Aggressive merchants can look to quick a revisit to the $1.15-$1.18 zone.

The Futures market famous robust bearish sentiment as properly

On 7 March, the funding fee slipped into unfavorable territory. On the identical time, Open Curiosity started to rise alongside the falling costs. This confirmed quick sellers had been robust out there. Within the 12 hours earlier than press time, the funding fee flipped optimistic as soon as extra.

The latest fall in MATIC costs from $1.16 noticed the OI decline – Additionally an indication of bearish sentiment because it underlined discouraged patrons.