In style quant analyst PlanB says the latest Bitcoin (BTC) rally isn’t the bull lure many traders are weary of.

PlanB tells his 1.8 million Twitter followers that a number of benchmark indicators are suggesting that what many imagine is a bull lure is in actual fact the beginning of a brand new bull cycle.

“To be clear, in my view present Bitcoin pump will not be a bull lure however the (early) begin of the subsequent bull run.”

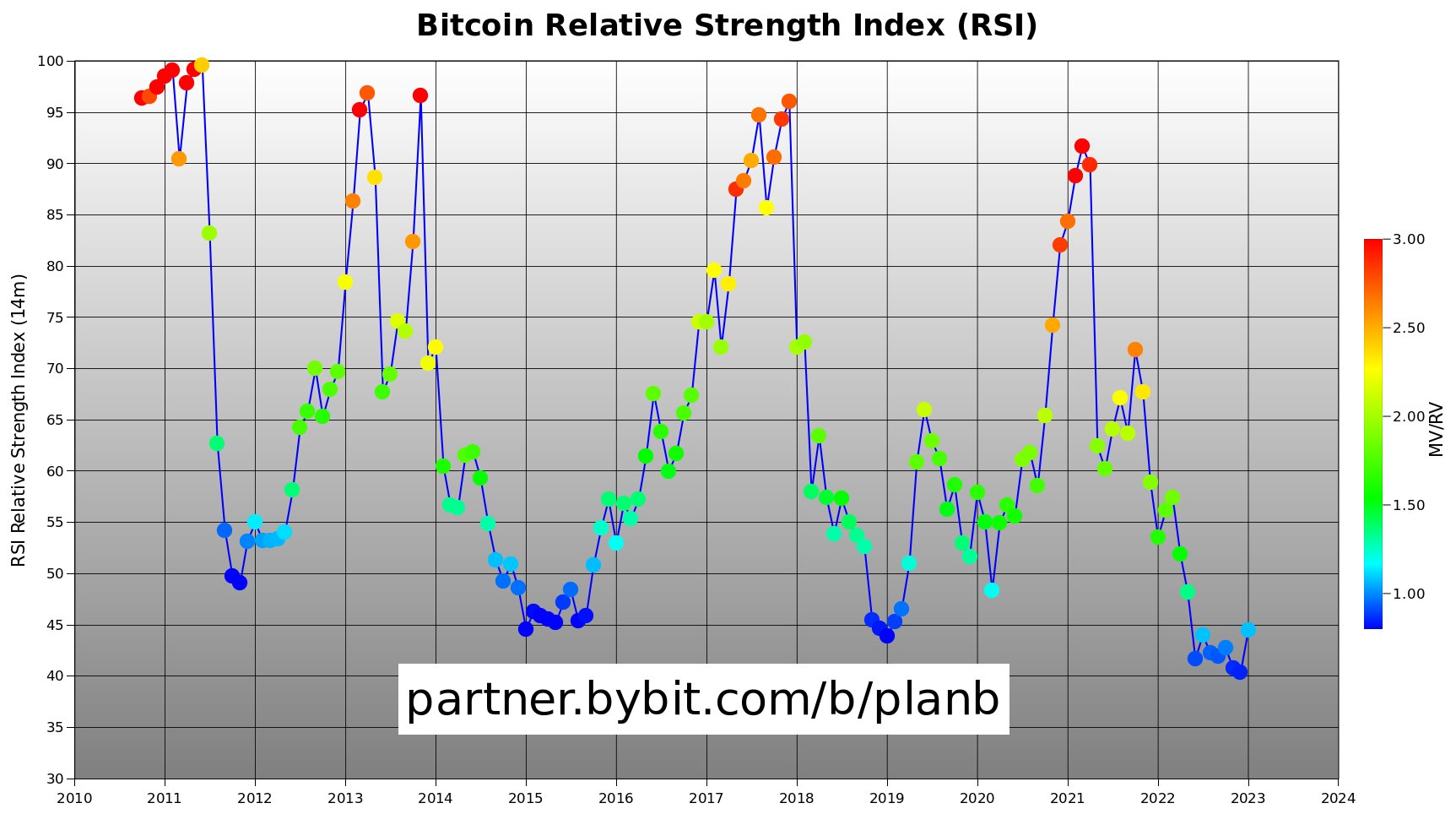

Plan B says that an upward transfer of the Relative Power Index (RSI) signifies bullishness for Bitcoin, although the RSI stays on the historic lows seen in each 2015 and 2019.

“Bitcoin is getting stronger (RSI).”

He says that Bitcoin has already discovered its backside for the present bear market cycle, doubling down on his earlier place that Bitcoin’s backside was $15,500 in November 2022. He predicts the subsequent halving occasion in 2024 will drive Bitcoin’s value to $32,000.

Plan B additionally says the historic value correlation between the S&P 500 index and Bitcoin reveals the king crypto asset has extra room to climb.

“BTC enjoying catch-up with S&P (S&P implied BTC value $54,000).”

“BTC has been correlated with S&P (and different property) from the beginning. The distinction is that if S&P jumps, BTC jumps a lot a lot more durable. Within the chart under S&P jumps from roughly 1,000 to 4,000, whereas BTC jumps from roughly 1 to twenty,000.”

At time of writing, Bitcoin is altering arms at $21,115.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Featured Picture: Shutterstock/Sensvector