San Francisco’s SoFi Financial institution, a rising monetary establishment with 6.2 million clients, has unveiled its substantial cryptocurrency holdings, demonstrating a proactive embrace of the evolving digital asset panorama.

BTC, ETH, and DOGE Lead the Means

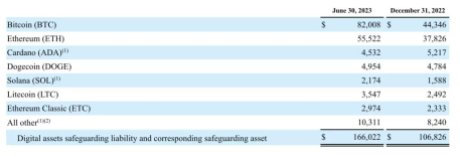

A latest report reveals that the financial institution’s second-quarter earnings totaled $170 million in varied cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE).

Amongst its cryptocurrency investments, SoFi Financial institution boasts $82 million value of Bitcoin, solidifying its place in ‘digital gold.’ Ethereum follows intently, with $55 million, showcasing the financial institution’s perception within the blockchain’s potential.

The meme-inspired Dogecoin takes the third spot with $5 million, whereas Cardano secures the fourth place with $4.5 million. The financial institution additionally diversifies with digital property like Solana (SOL), Litecoin (LTC), and Ethereum Traditional (ETC).

SoFi Financial institution's crypto holdings | Supply: X

SoFi Financial institution’s distinctive proposition lies in its dedication to fee-free cryptocurrency investments, permitting clients to allocate a portion of their direct deposits to digital property.

The financial institution additional incentivizes newcomers by providing a $100 crypto bonus upon registration. With a minimal funding threshold as little as $10, the platform fosters accessibility to quite a lot of cryptocurrencies past Bitcoin.

Whereas SoFi Financial institution’s modern strategy to cryptocurrency has garnered consideration, it faces regulatory scrutiny, notably from the USA Federal Reserve. The regulatory physique has raised considerations over the financial institution’s involvement in crypto-related actions, requiring alignment with established insurance policies. The financial institution has been given till January 2024 to make sure compliance, a course of that entails navigating regulatory capital remedy intricacies.

Based in 2011, SoFi Financial institution transitioned from its standing as a non-bank entity in 2019 to a fully-fledged monetary establishment the next 12 months.

BTC value falls to $29,300 | Supply: BTCUSD on Tradingview.com

Strategic Development And Monetary Success

The earnings report highlights SoFi Financial institution’s enterprise acumen, mirrored in its robust second-quarter efficiency. With a outstanding 37% surge in income ($498 million) in comparison with the earlier 12 months, the financial institution showcases its means to thrive amidst a quickly evolving monetary panorama.

SoFi Expertise Inventory additionally witnessed a 17% surge in July following its Q2 report. “Because of this progress in high-quality deposits, we’ve got benefited from a decrease value of funding for our loans,” SoFi CEO Anthony Noto stated.

SoFi shouldn’t be the one financial institution that has made its approach into cryptocurrencies. Main US banks like Wells Fargo, JP Morgan, and Goldman Sachs, amongst others, have additionally taken the plunge to supply entry to digital property and cryptocurrencies for his or her purchasers.

Different notable entrants into the business embrace BlackRock and ARK Make investments, which have filed functions for Spot Bitcoin ETFs with the SECs. On August 13, the primary of those, the ARK Make investments utility, will be deliberated on to be approved or rejected by the SEC. Nevertheless, the regulator may additionally find yourself extending the deadline.

Featured picture from BitIRA, chart from Tradingview.com