The previous week has painted a vivid image of shifting investor sentiment worldwide. Whereas Bitcoin and the broader cryptocurrency market witnessed a major outflow of funds from funding merchandise like ETPs, ETFs and funds, Solana (SOL) emerged as a beacon of hope for altcoin fans.

A Dive Into The Numbers By Crypto Merchandise

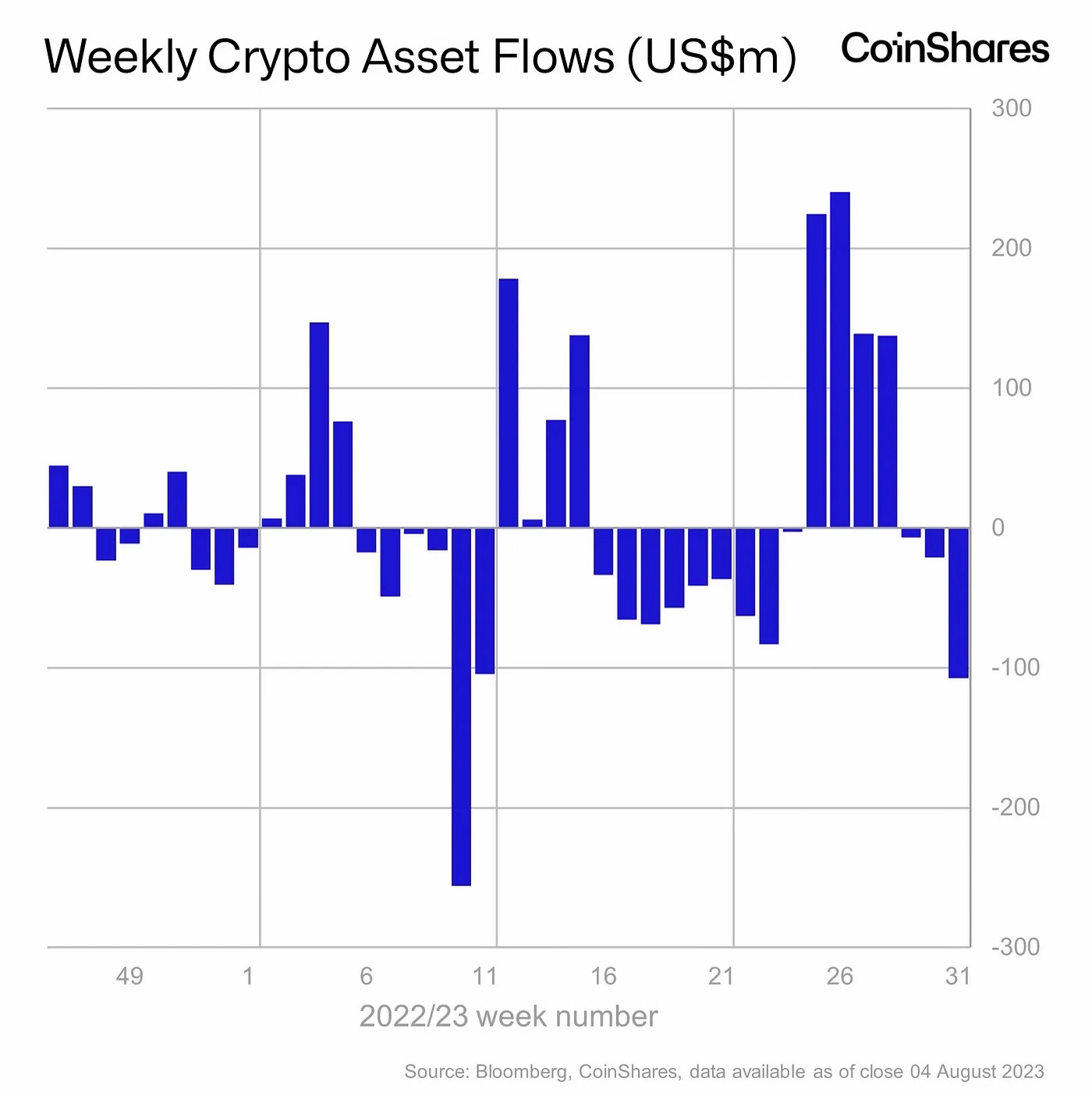

Digital asset funding merchandise skilled a internet outflow of $107 million this week, a determine that underscores the rising pattern of profit-taking that has been evident in current weeks. “Digital asset funding merchandise noticed outflows this week, totalling $107m with revenue taking gathering tempo in current weeks,” James Butterfill famous in his current report printed in CoinShares’ weblog.

Bitcoin, the de facto king of cryptocurrencies, bore the brunt of those outflows, seeing a staggering $111.4 million depart its coffers. This marks the “largest weekly outflows since March,” a time when US regulatory scrutiny started to accentuate. Curiously, for the primary time in 14 weeks, the outflows into quick bitcoin positions have additionally come to a halt.

Ethereum wasn’t spared both. The second-largest cryptocurrency by market capitalization noticed outflows totalling $5.9 million, bringing the mixed outflows for each Bitcoin and Ethereum to $117.3 million in simply the previous week.

Solana Is The Rising Star

Amidst this backdrop of outflows, Solana stood out, not only for its resilience, however for its spectacular inflows. The altcoin witnessed the “largest inflows, totaling $9.5m, the biggest single week of inflows since March 2022.” This surge in curiosity has propelled Solana’s Belongings Below Administration (AUM) to $89 million. With month-to-date inflows equalling $9.5 million and year-to-date inflows at $25 million, Solana is clearly on an upward trajectory.

To place this in perspective, Bitcoin has the biggest AUM with $24,136 million, adopted by Ethereum with $7,820 million and multi-asset funding merchandise with $3,060 million. Litecoin ($134 million) and Bitcoin Brief ($104) even have greater AUM than Solana. Nonetheless, Solana’s AUM has now surpassed that of established altcoins like XRP ($74 million), Cardano ($28 million), and Polygon ($24 million).

Whereas Solana basked within the limelight, different altcoins had a combined week. XRP and Litecoin registered modest inflows of $0.5 million and $0.46 million respectively. Nonetheless, Uniswap and Cardano weren’t as lucky, witnessing outflows of $0.8 million and $0.3 million respectively.

Regionally, the outflows have been predominantly concentrated amongst two ETP suppliers in Germany and Canada, which noticed outflows of $71 million and $29 million respectively.

SOL Worth Evaluation

At press time, the Solana (SOL) value was buying and selling at $23.05, above the 200-day EMA. If SOL manages to defend the 200-day EMA within the following days and make sure the breakout from the descending triangle, the chart seems very bullish. The subsequent resistance stage may be anticipated on the 50% Fibonacci retracement stage ($24.00), earlier than one other transfer to the 61.8% Fibonacci stage at $27.44 appears attainable.

Featured picture from iStock, chart from TradingView.com