- BTC’s accumulation pattern was attention-grabbing and will affect BTC’s value.

- On-chain metrics painted a impartial image as a couple of of them supported the bulls.

On 23 February, Santiment identified an attention-grabbing pattern in Bitcoin [BTC] accumulation amongst sharks and whales. As per the tweet, addresses with 100-1000 BTC turned stagnant whereas BTC’s value hovered throughout the vary of $23,000 – $25,000.

???????? The quantity of shark & whale #Bitcoin addresses are staying flat because the $23k to $25k value vary continues. If the 1K-10K $BTC addresses start to rise the best way the 10-100 and 100-1K $BTC addresses have up to now 3 months, it might be a breakout signal. https://t.co/xs7D99BzQ1 pic.twitter.com/P7HwCGeMoT

— Santiment (@santimentfeed) February 23, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Then again, addresses with a stability of 1,000 – 10,000 BTC continued to say no. The tweet additionally highlighted the potential for a northbound breakout of BTC’s value if addresses with 1,000 – 10,000 BTC registered a rise within the coming days.

This is usually a good shopping for alternative

Joaowedson, an analyst and writer at CryptoQuant, revealed an analysis on 24 February, which identified the present market pattern for BTC. As per the evaluation, the 350-day shifting common (MA) and the 100-day exponential shifting common (EMA) of the Taker Purchase Promote Ratio indicator can determine adjustments in Bitcoin’s value pattern.

Native bottoms and tops within the value of bitcoin could be recognized when the 100-day exponential shifting common crosses a hard and fast worth line of 1. Wanting on the present chart, there was a very good shopping for alternative because the 100-day EMA reached the mounted worth line of 1.

The place is the market heading?

In keeping with CoinMarketCap, BTC’s value registered a decline of practically 2.5% within the final 24 hours, and on the time of writing, it was buying and selling at $23,942.46 with a market capitalization of greater than $462 billion. A deeper take a look at BTC’s on-chain metrics supplied by CryptoQuant gave a greater understanding of the market situation and make clear the trail BTC may take within the coming days.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

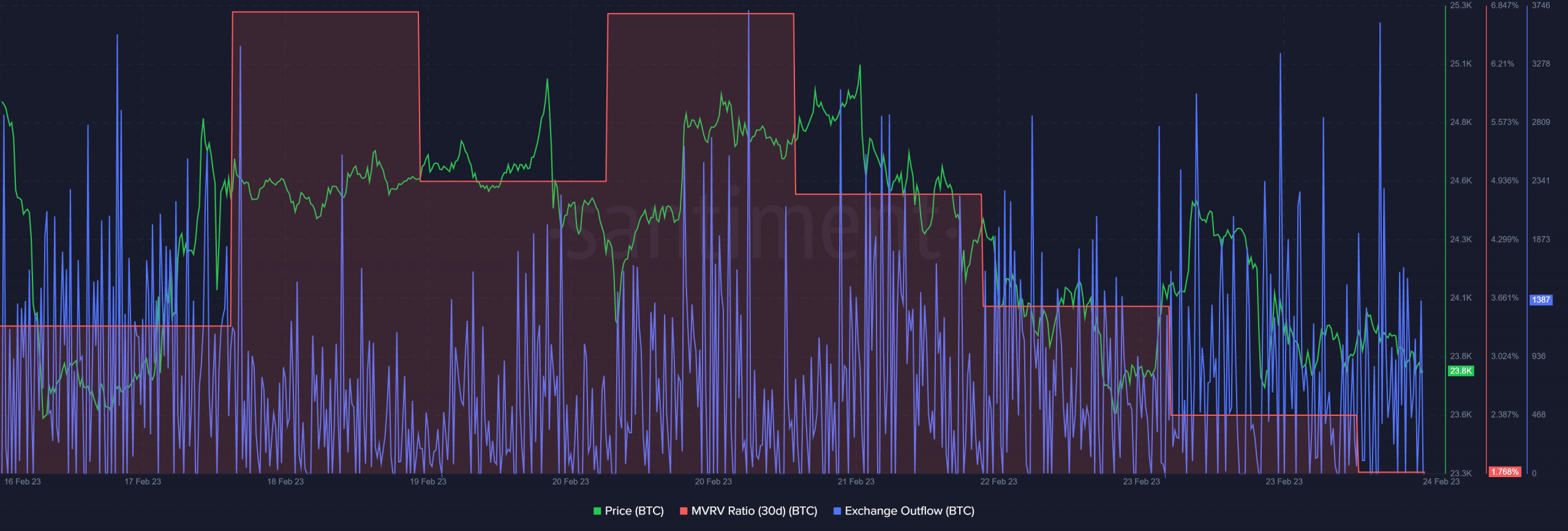

As an example, BTC’s change reserve was reducing, which was a growth within the patrons’ favor, because it indicated decrease promoting strain. One other constructive metric was BTC’s funding fee, because the lengthy place merchants have been dominant and prepared to pay quick place merchants. Furthermore, BTC’s change outflow was additionally persistently excessive, which was a bullish sign.

Nonetheless, not every part was working in BTC’s favor. The king coin’s MVRV Ratio registered a decline during the last week. BTC’s aSORP was additionally crimson, suggesting that extra buyers have been promoting at a revenue.

Supply: Santiment

![What are Bitcoin [BTC] whales up to? Decoding…](https://thewealthpulse.com/wp-content/uploads/2023/02/BTC-2-1000x600.jpg)